from http://finance.yahoo.com/news/heres-donald-trumps-net-worth-105900147.html

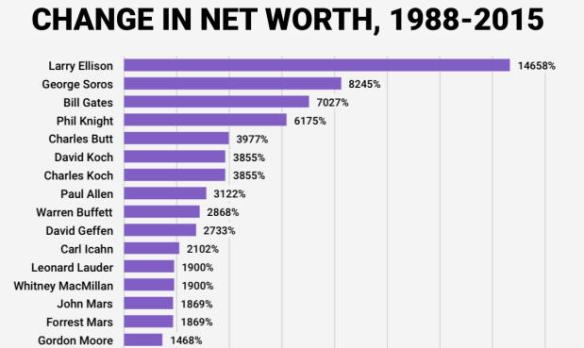

Since 1988 the S&P 500 returned 713%. According to Yahoo Finance (link above), 15 people have done twice as well or better. That is a very small number. There may be others, of course, but they are not wealthy enough to have been mentioned.

Only 4 of these people did 4x the S&P return. Donald Trump did only half as well as the S&P 500. That’s still better than I did during the period. I admit my long term returns are bad. I did not even hear of the “equity premium” until 2002, and did not understand the principle of index investing until about 2013, the year I published a paper on on the equity premium and wrote a book about it. At that time, I was already invested in some things that were destined to crash, and was not brave enough to exit them (Russia, mainly), especially as they were doing great at the time.

Most of the S&P’s gain, for that period, came between 1988 and 2000. Since then it’s been relatively flat. From the 2000 peak to the May 2015 peak, the rate of price return was less than 1.8% per year. Dividends during that period averaged about 2%, giving a total return of about 3.8%, better than treasury bonds, but not quite as good as corporate bonds. Did the equity premium disappear?

Since the 2008 peak, before the financial crisis, price gain has been 3.8% per year, for a total return of around 6% and beating grade A bonds by a couple of percent. If you are curious about the dividend history of the S&P 500, you can find it here. In the 1800s it was 4-6% range. It tends to spike when the market crashes, like in the 1930s, simply because the price of the stocks takes such a hit. The dividend yield fell to 3% in the 1960s, rose briefly around 1980, and declined to 1% at the peak of the internet bubble in 2000. Since then it has been generally rising.

I expect it to continue to rise. I’d be surprised if dividends were less than half of returns going forward. I’m assuming comparison based on peak to peak. Obviously if you can time the market you can do better, but I don’t know anyone who can. There are a lot of headwinds to growth going forward, including the rise of political instability, and the maturation of several developing economies such as India and China. China has grown by stealing other people’s markets with cheap labor. They even stole from Latin America and Japan, not just from the U.S. and Europe. They could grow further this way, for example by making cars, but it’s not likely to be as rapid, and they have a quality and image issue which they have not yet aggressively addressed the way Japan did in the 1960s.